KEY TAKEAWAYS

- Falling real yields continue to support gold’s strength, while a rebound in yields could limit gains.

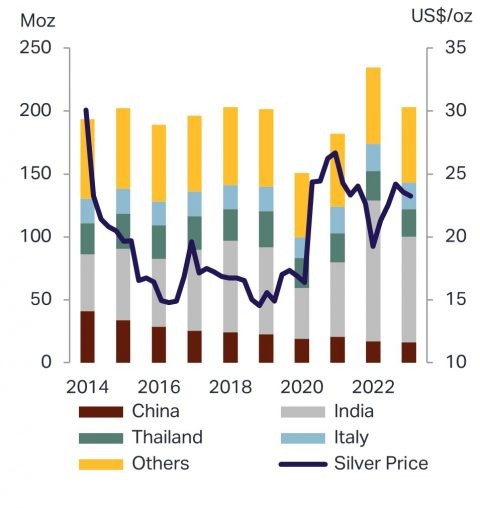

- India’s festival season and slower silver imports are tightening physical silver supplies.

- Central banks and ETFs remain steady buyers, helping to maintain a price floor for gold.

Gold gains from weaker real yields and steady fund demand. Silver tightens on festival buying and lower imports in India and China.

Gold has shown strength as the 10-year TIPS yield has eased and large funds added metal this year. Silver has seen firmer local demand, especially small coins and jewelry, while imports remain below recent norms.

This week, data on real yields, US inflation, India festival buying, and ETF flows will set the tone.

ALSO READ:2025 Treasury Moves Drive Safe-Haven Flows Into Gold and Silver

Real Rates And Macro Signals

Understanding real yields is crucial for evaluating precious metals. Unlike nominal yields, which can misguide investors, real yields reflect the actual returns after accounting for inflation. Specifically, when the 10-year TIPS yield falls, gold becomes increasingly appealing as the cost of holding non-yielding bullion declines.

In the coming days, keep an eye on US inflation data and comments from the Federal Reserve, as these can significantly impact real yields and, consequently, both gold and silver prices. A notable drop in real yields typically propels gold prices upward, while rising yields create downward pressure.

RECOMMENDED:Central Banks and Long-Term Investors Fuel Gold’s Surge

Jewelry Seasonality And Physical Demand

India and China play significant roles in driving physical demand for both gold and silver, particularly around the festival seasons. Events like Dhanteras and Diwali spur a surge in retail purchases, tightening local supplies when imports are lower than usual.

Recent reports indicate that India experienced below-average silver imports earlier this year, which may amplify price fluctuations if festival demand remains strong. As such, local retail flows will likely exert more influence on silver prices than paper markets in the upcoming week.

RECOMMENDED:Smart Investors Are Buying Gold in 2025: 9 Must-Know Reasons

ETF Flows And Central Bank Purchases

Exchange-traded funds (ETFs) and central banks provide tangible indicators of investor sentiment. Year-to-date, gold ETFs have witnessed net inflows, signifying growing interest among investors. Moreover, central banks are actively increasing their gold reserves, which helps to establish a supportive price floor.

Monitoring daily GLD and SLV creations along with weekly ETF flow summaries is key, as significant redemptions or creations can initiate rapid price movements. While mining output and producer hedging commonly influence medium-term trends, they are less impactful on immediate market fluctuations.

RECOMMENDED:Overbought Signals in Metals: Will Gold and Silver Pullback?