Silver Surges to Historic High: The Dual Role Driving Its Demand

Silver has recently reached a historic high of ₹1.16 lakh per kilogram in the Ahmedabad market, marking a remarkable increase driven by a confluence of factors that are reshaping the landscape of precious metals.

A Rapid Rise in Prices

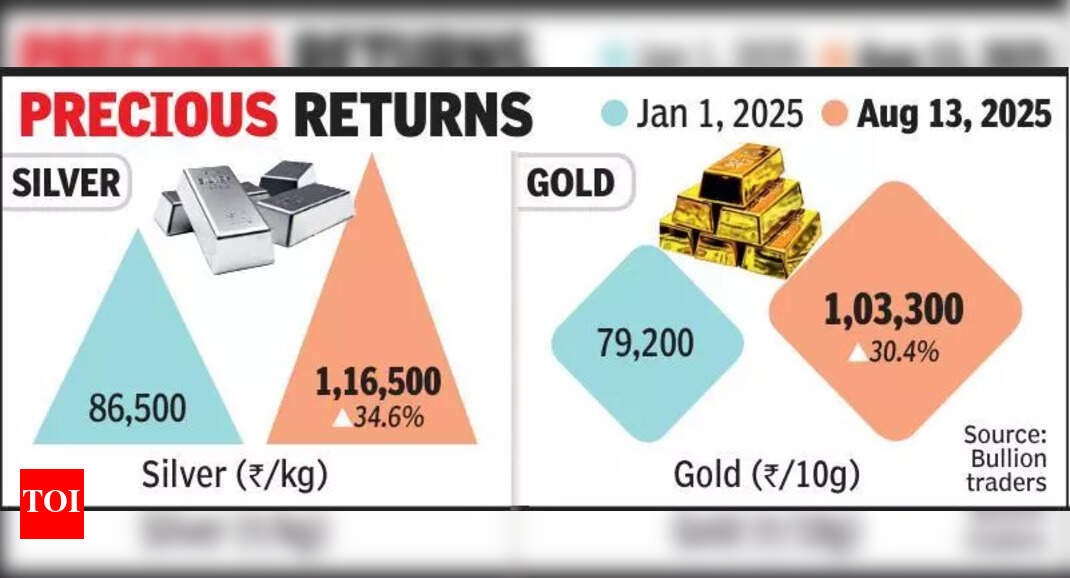

The price trajectory for silver has been nothing short of extraordinary. At the start of the year, silver was trading at ₹86,500 per kilogram. By weighing in at ₹1.16 lakh, this represents an impressive gain of 34.6% within a span of just a few months. In contrast, gold, albeit having its own rally, has seen a gain of around 30.4%—from ₹79,200 per 10 grams at the beginning of the year to ₹1.03 lakh per 10 grams currently. The significant uptick in both these metals can be attributed to a growing flight to safe-haven assets amid rising geopolitical tensions and robust inflationary concerns worldwide.

Geopolitical Tensions and Global Demand

As conflicts ensue and economic uncertainties loom, investors have increasingly sought refuge in precious metals. With central banks around the globe substantially ramping up their gold and silver procurements, the heightened global demand has contributed to the upward trend in prices. The combination of supply chain disruptions and increased consumption in industrial sectors further propels the silver market.

Silver’s Unique Position: Precious Metal Meets Industrial Material

Unlike gold, primarily driven by investment and jewelry demand, silver occupies a unique dual role. It serves not only as a coveted precious metal but also as a crucial industrial material. Silver is extensively employed in electronics, solar panels, and electric vehicles. This industrial demand provides a significant boost to its market price, making it attractive for both investors and industrial consumers.

Shifting Buyer Preferences: Silver as an Alternative to Gold

As gold prices continue to escalate, particularly in light of crossing the ₹1 lakh mark, many consumers are opting for silver as a more affordable alternative. Jewelry buyers, especially those from rural backgrounds or lower-income brackets, are increasingly gravitating towards silver ornaments. This shift has led jewelers to expand their offerings, with many now opening dedicated showrooms focused on silver jewelry to meet rising demand.

Hemant Choksi, a bullion trader based in Manek Chowk, pointed out that silver has become the "new gold." Many jewellers are expected to adapt as preferences shift, providing a broader range of silver options, including heavy jewelry and customized artifacts. The widening price gap between gold and silver suggests that consumers might continue to favor silver for their ornament needs.

The Future Outlook: Sustained Momentum and Potential Volatility

With both strong investment and consumption supporting silver’s rally, market analysts suggest that its upward momentum could continue in the near term. However, the potential for profit-booking could introduce short-term volatility. This volatility could be a natural response to the fast-paced rise in prices, reflecting the behavior of investors who might wish to cash in on recent gains.

The Burgeoning Market for Silver Jewelry

As the price of gold reaches new heights, silver jewelry is becoming increasingly prevalent, especially among those who may have previously opted for gold. The transition indicates not just a change in consumer preference but also highlights the evolving dynamics of the jewelry market. Smaller jewelry retailers and local artisans are capitalizing on this trend, crafting silver pieces that are both aesthetically pleasing and economically viable.

A growing number of consumers are now looking for elaborate silver designs as a way to express themselves without incurring the heavy financial burden of gold. As the popularity of silver jewelry escalates, it paints a vivid picture of a marketplace undergoing transformation.

Silver’s surge is a testament to its timeless appeal, blending utility with luxury. In an environment marked by volatility and uncertainty, this precious metal is not just a safe haven but also an emblem of changing consumer behavior and industrial evolution. As demand continues to rise, silver’s dual role—both as an investment and a key industrial resource—will likely dictate its market trajectory in the months to come.