China’s Technological Ambitions: The Race for Chip Supremacy

In recent years, the global technology landscape has experienced significant shifts, primarily characterized by the competitive joust between the United States and China. For decades, the US has maintained a dominant position in the tech industry, but China, armed with ambition and substantial investment, is determined to alter the status quo.

A New Era for China’s Tech Sector

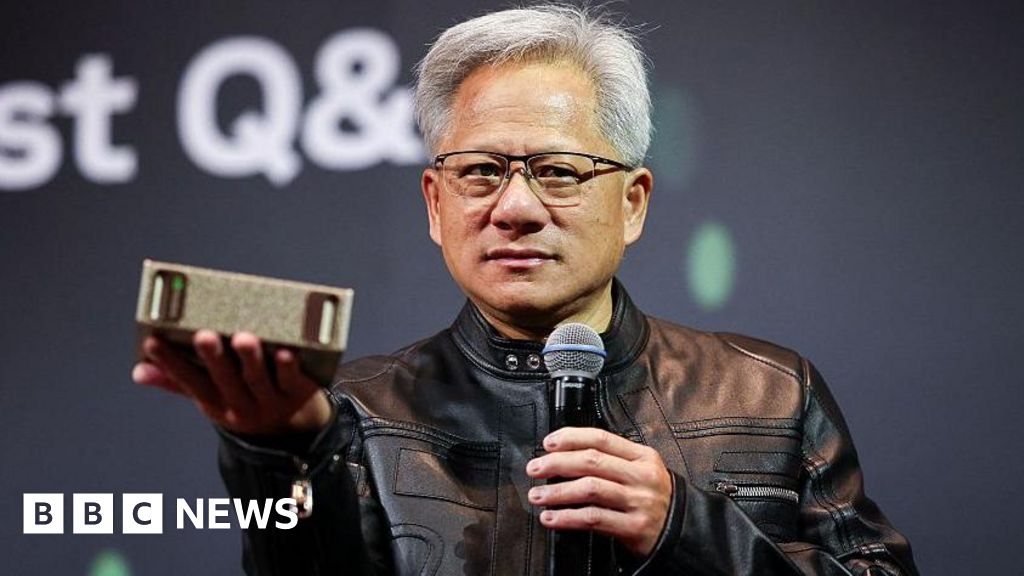

China is no longer just the world’s manufacturing hub; it aims to become a leader in artificial intelligence (AI) and robotics. The Chinese government is pouring enormous resources into the development of high-end semiconductors, the essential building blocks of modern technology. This commitment is underscored by the words of Jensen Huang, the CEO of Nvidia, who recently indicated that China is now "nanoseconds behind" the US in chip development. This timeline highlights the rapid advancements being made by Chinese firms, and the stakes involved have never been higher.

The Impact of DeepSeek

China’s tech landscape took a notable leap in 2024 with the emergence of DeepSeek, a company that launched a compelling alternative to OpenAI’s ChatGPT. The startup’s AI model not only generated buzz for its capabilities but also for its cost-effectiveness in training compared to other leading models. What’s even more remarkable is that DeepSeek reportedly achieved its feats using fewer high-end chips than its competitors, leading to a temporary drop in Nvidia’s market valuation. This episode encapsulates the shifting tides in the tech industry, with China making significant strides that could disrupt established players.

Rising Competitors

Momentum within China’s tech sector has not waned. Major companies like Alibaba have announced chips that claim to rival Nvidia’s H20 semiconductors while consuming less energy. Similarly, Huawei has unveiled its most powerful chips to date, alongside a strategic plan aimed at capturing market share from Nvidia. Furthermore, by making its designs and software publicly available within China, Huawei is looking to diminish local reliance on US products. Other Chinese firms, such as MetaX and Cambricon Technologies, are also joining the fray, securing substantial contracts that underline their ambitions to supply advanced chips domestically.

The Nvidia Response

Nvidia is taking the news of China’s advancing chip capabilities seriously. The company’s spokesperson acknowledged the burgeoning competition, stating, “The competition has undeniably arrived.” Nvidia aims to retain its edge by continually working to earn the trust of developers globally. Still, despite these reassurances, experts caution against taking Chinese chipmakers’ claims at face value due to inconsistent testing benchmarks and a lack of publicly available performance data.

Performance Gaps Persist

In terms of predictive analytics, Chinese semiconductors hold competitive advantages. However, experts highlight a performance gap in complex analytical tasks, suggesting that while the gap is narrowing, it may take time for Chinese innovations to fully catch up. This sentiment reflects a nuanced reality; while there is potential for advancement, obstacles remain.

Strengths and Weaknesses of the Chinese Tech Ecosystem

Nvidia’s Huang recently praised China’s vibrant tech sector, acknowledging its substantial talent pool and domestic competition. This has significant implications for how the country is transforming its economy, shifting its focus from manufacturing to cutting-edge technology. President Xi Jinping’s "high-quality development" initiative encapsulates China’s efforts to confront its technological limitations, particularly in the semiconductor sector.

Strategic Investments Amidst Trade Tensions

For years, China has invested heavily to minimize its dependence on Western technologies, a goal that has gained urgency amidst ongoing tariffs and trade disputes with the US. Xi’s vision aims for self-reliance, emphasizing that China’s future should not hinge on external "gifts." This determination pushes Beijing to cultivate a stronger domestic technology landscape.

Challenges in Innovation and Adaptation

While the ambitions are grand, the state-led approach can sometimes stifle agility within the tech sector. Professor Chia-Lin Yang from the National Taiwan University points out that a singular focus on shared goals can limit disruptive innovations. Moreover, Chinese chips are still frequently criticized for being less user-friendly compared to those from Western competitors.

China’s Strategic Moves on the Global Stage

Some analysts suggest that China’s recent advancements in its chip sector may act as a bargaining chip in ongoing negotiations with the US over tariffs. By showcasing its capabilities, Beijing aims to strengthen its position and compel Washington to reconsider export restrictions on technology. Despite the significant progress, however, there is still a dependency on American technology for the most advanced projects.

Looking Ahead: The Five-Year Horizon

Experts agree that while China is making strides toward self-sufficiency, it will still rely on US chips for certain high-end applications in the near term. Nonetheless, predictions suggest that if current trends continue, China could reduce its reliance on American technology significantly within the next five years.

The global tech race is more vibrant than ever, with China steadily positioning itself as an essential player capable of challenging traditional power dynamics. The implications for businesses, consumers, and global politics are profound, setting the stage for a competition that will likely shape the future of technology as we know it.