New Delhi: Over the past year, the investment landscape has been anything but stable, yet certain assets have emerged as shining stars, delivering remarkable returns for savvy investors. Gold (99.9 purity) has skyrocketed nearly 40 percent, now trading above Rs 1 lakh per 10 grams. Silver has followed closely, appreciating over 44 percent to hover around Rs 1,16,000 per kg. Meanwhile, Bitcoin has demonstrated an unprecedented surge, soaring more than 111 percent to touch $1,17,293 as of August 17, 2025. These gains have unfolded amidst global equity markets grappling with trade wars, geopolitical tensions, and unpredictable central bank policies, rekindling interest in traditional safe havens and newer alternative assets.

A Shift Towards Safe Havens

As economic uncertainty takes center stage, investors find themselves at a crossroad, questioning: Which asset should they choose? Historically, gold and silver have been regarded as reliable stores of value, while Bitcoin has entered the fray as a modern contender. This shift emphasizes the importance of safe-haven investments, arising from fears of inflation and currency devaluation that have prompted many to reconsider their financial strategies.

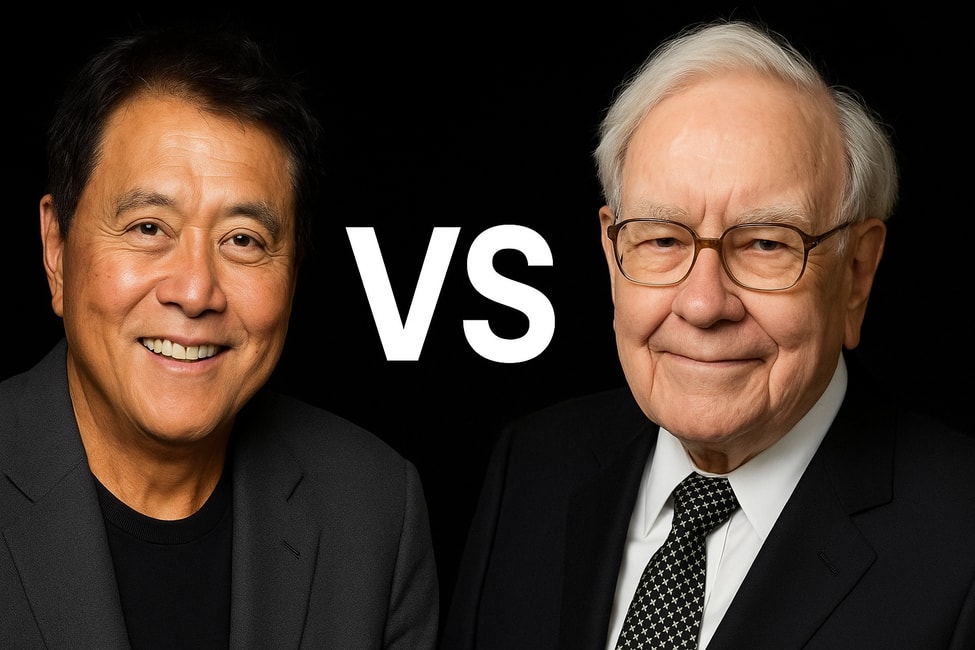

Kiyosaki’s Case: Gold, Silver, and Bitcoin as “Real Money”

Esteemed author and financial educator Robert Kiyosaki, known for his influential book “Rich Dad Poor Dad,” argues vehemently against the reliability of fiat currencies. He describes such government-issued money as “fake,” subject to inflation that silently erodes the wealth of the poor and middle class. Kiyosaki’s perspective is that only “real money”—gold, silver, Bitcoin, real estate, and natural resources—can safeguard wealth against the whims of inflation. He controversially terms Bitcoin as “digital gold,” underscoring its innovative potential as a storied asset alongside gold and silver, which have historically provided a dependable hedge against economic turmoil.

Reflecting on the past year, Kiyosaki’s arguments resonate deeply:

- Gold and silver have delivered returns exceeding 40 percent.

- Bitcoin has more than doubled in value, affirming its resilience.

- In contrast, paper currencies have suffered significant depreciation in purchasing power.

His advice is straightforward: to escape the grip of inflation, one must invest in real assets rather than relying solely on cash savings, which he considers insufficient in today’s economy.

Buffett’s Perspective: The Value of Productive Assets

In stark contrast, Warren Buffett, recognized globally as the “Sage of Omaha,” espouses a different investment philosophy. Buffett champions productive assets—those that generate value, income, or bolster businesses. He regards gold as merely “a way of going long on fear,” dismissing its lack of intrinsic value. For Buffett, while gold and silver have some merit (the latter due to its industrial applications in sectors like electronics and healthcare), Bitcoin is particularly egregious in his eyes; its inability to produce goods or provide services renders it devoid of fundamental value.

Buffett’s approach prioritizes equities, emphasizing the importance of investing in companies with strong fundamentals, solid management teams, and a dedicated customer base. His time-tested strategy revolves around purchasing undervalued firms and holding them long-term, in contrast to the more speculative nature of gold and cryptocurrency investments.

Real Estate and Equities: Distinct Investment Priorities

When it comes to real estate, Kiyosaki stands firm, viewing it as both an appreciating asset and a reliable source of cash flow through rental income. He considers the stock market comparatively risky, favoring investments that provide immediate cash returns and long-term appreciation. In contrast, Buffett relies heavily on equities, showing little interest in real estate. For him, the potential for growth in productive businesses aligns better with his investment philosophy, which seeks to achieve wealth through ownership stakes in companies capable of delivering ongoing profits.

The debate between these two investment icons—Kiyosaki with his focus on real assets and safe havens, and Buffett’s preference for productivity and value creation—highlights the complexity of modern financial decision-making. Each perspective offers invaluable insights as investors navigate an unpredictable market.

(Disclaimer: This article is meant purely for information and should not be treated as investment advice.)