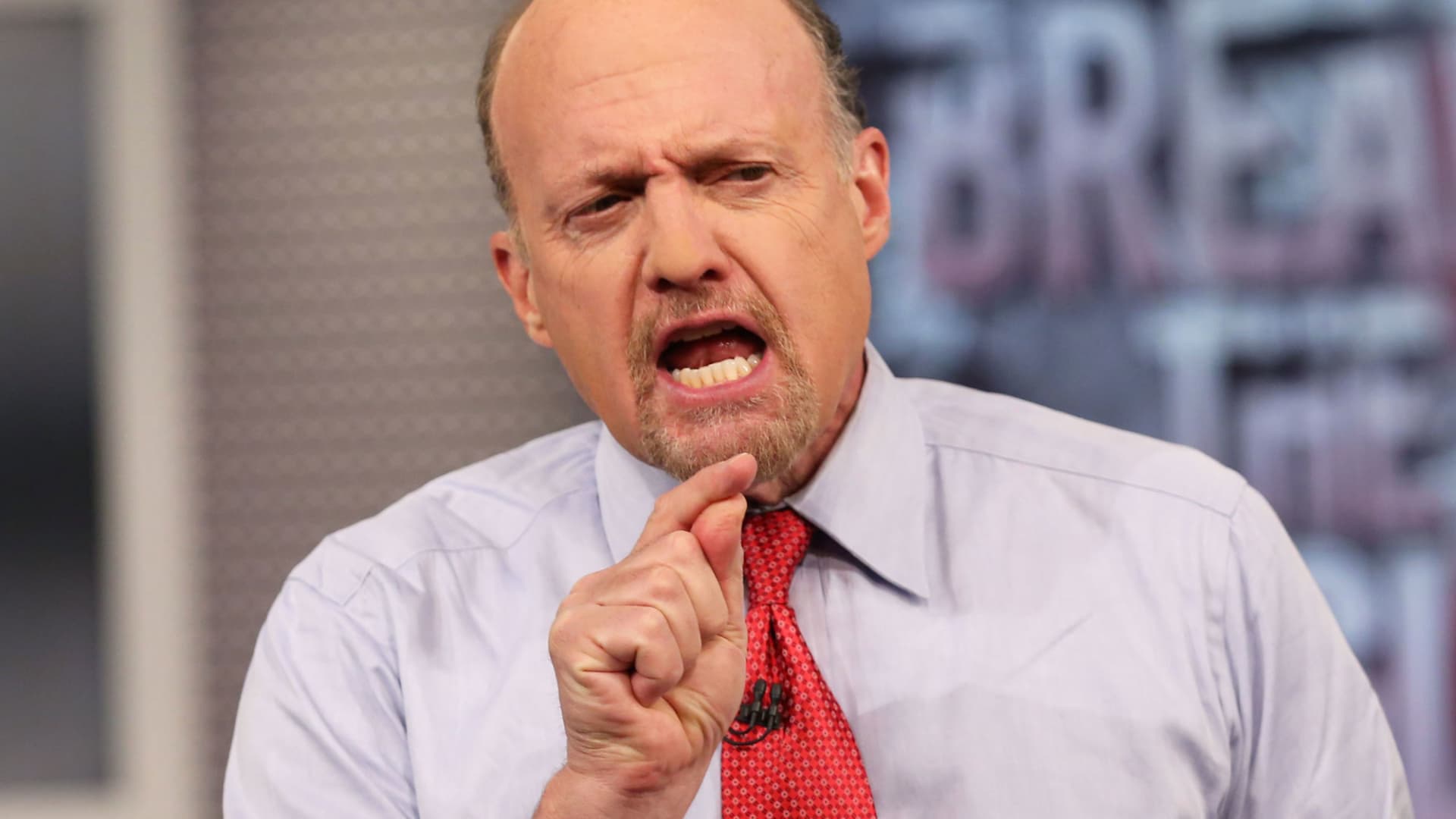

Jim Cramer’s PARC Stocks: A Look at Momentum Amid Market Dynamics

On a recent CNBC segment, renowned financial commentator Jim Cramer showcased a compelling selection of stocks he believes possess significant momentum, particularly fueled by the excitement of retail investors. The stocks in focus—Palantir, AppLovin, Robinhood, and Coinbase—collectively dubbed “PARC”—highlight a notable trend within today’s investment landscape.

The PARC Phenomenon

Cramer’s categorization of these stocks as “PARC” reflects their recent surge, marking them as emblematic of a peculiar bifurcation in the stock market. He stated, “These PARC names are emblematic of how stocks have devolved into a two-track market.” On one track, we find the traditional S&P 500 companies; on the other, a select group of stocks that have captured the relentless attention of retail investors.

While many stocks pull back occasionally, Cramer believes that the PARC stocks are likely to rebound. He suggests that these companies not only have the potential for solid earnings but have also garnered favorable attention from market analysts. However, the interest from retail investors appears to transcend traditional metrics, leading some to become what he describes as “irrational believers” in the growth stories of these firms.

Stocks on the Radar

-

Palantir (PLTR): Known for its data analytics capabilities, this company has captivated many investors seeking tech-driven growth opportunities.

-

AppLovin (APP): A significant player in mobile marketing, AppLovin has shown potential for continued earnings, appealing to investors looking for fresh technologies.

-

Robinhood (HOOD): This popular trading platform has generated buzz with its user-friendly interface and commission-free trades, making it particularly attractive to a new generation of investors.

-

Coinbase (COIN): As a leading cryptocurrency exchange, Coinbase stands at the intersection of traditional finance and the growing digital assets sector, spotlighting its relevance in today’s market.

The Makings of a Two-Track Market

Cramer identifies a disconcerting theme in the current market landscape: the divergence between well-established companies and a handful of trendy stocks that have risen to prominence, often driven by retail investor enthusiasm rather than foundational economic indicators.

He emphasized that retail investors are gravitating towards sectors that symbolize the future, such as quantum computing and cryptocurrencies. Noteworthy names mentioned by Cramer include:

- Strategy (MSTR): Focused on Bitcoin as a treasury reserve asset, this stock is drawing investor attention.

- Oklo: Engaged in advanced nuclear technology, appealing to sustainability-focused portfolios.

- Rocket Lab (RKLB): A player in the space industry, capturing interest amidst growing aspirations for aerospace advancements.

- QuantumScape (QS) and Joby Aviation (JOBY): Both companies are spearheading innovations in battery technology and eVTOL aircraft, respectively.

Navigating the Investment Terrain

Cramer advocates for a nuanced approach when considering investments in PARC stocks. While he acknowledges that there are opportunities for profit in these names, he cautions that investors should maintain a level of discipline in their strategies. “You can pick some of these stocks to own as long as you don’t flood the zone with them,” he asserts, recommending that investors “take something off the table” upon realizing substantial gains.

Market Dynamics and Future Trends

The discussion around PARC stocks also touches on market performance fluctuation. Cramer concluded his thoughts by indicating that, aside from brief pauses in momentum, these stocks continue to demonstrate resilience. He expressed a belief that unless there’s a wave of new IPOs introducing a supply glut, the upward trajectory of these stocks is likely to persist.

By keeping an eye on these trends and adjusting investment strategies accordingly, investors can position themselves for potential growth within this dynamic market environment. The excitement generated by these stocks signals a shift in what drives retail investor interest, marking a new chapter in stock market engagement.