Strategic Metals Ltd. Unveils Promising Exploration Results at Triple Crown Project

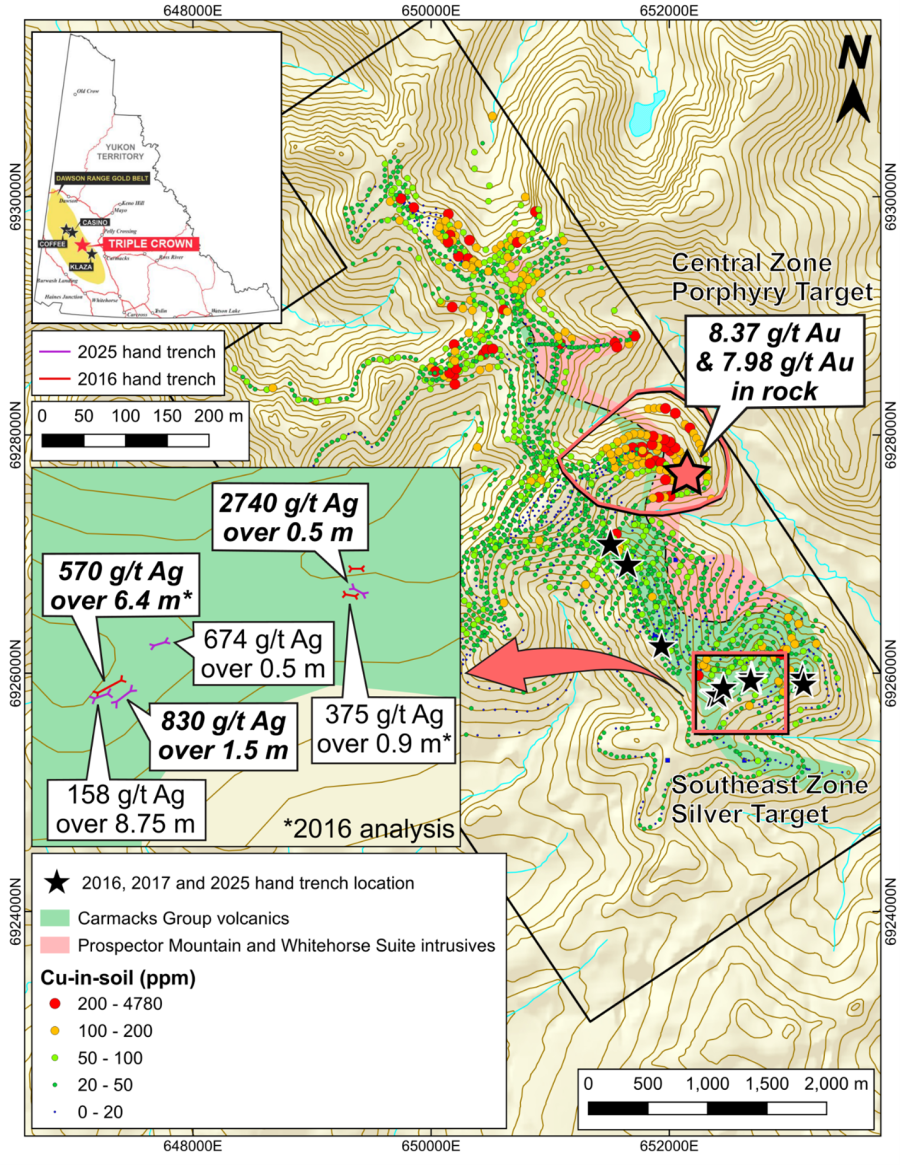

Vancouver, BC – August 19, 2025 – Strategic Metals Ltd. (TSXV:SMD), a dynamic player in the mining sector, has exciting news stemming from its latest exploration efforts at the wholly-owned Triple Crown Project in southwest Yukon. Nestled within the Dawson Range Gold Belt, a geological haven that contains notable deposits like Coffee, Casino, and Klaza, the Triple Crown Project is showing impressive potential for significant mineral finds.

Overview of the Exploration Program

In June 2025, the company executed a detailed program involving geological mapping, prospecting, and hand trenching at the Southeast Zone of the Triple Crown Project. This area has a rich history of mineralization, evidenced by trenches dug in 2016 that returned astonishing results of 570 g/t silver over 6.4 m. Now, in 2025, fresh excavations along strike have revealed even more remarkable assays.

Exceptional Trenching Results

The 2025 trench results are indeed noteworthy. Continuous chip samples from the freshly excavated trenches have yielded record highlights:

- 2740 g/t silver over 0.5 m

- 830 g/t silver over 1.5 m

- 158 g/t silver over 8.75 m

These figures not only underscore the exceptional tenor of the mineralization at Triple Crown but also highlight the effectiveness of Strategic’s exploration efforts. Below is a summary of the trench results:

| Trench ID | Sample Interval (m) | Silver (g/t) | Lead (%) |

|---|---|---|---|

| TR-25-01 | 8.75 | 158 | 2.15 |

| TR-25-02 | 1.50 | 830 | 7.76 |

| TR-25-03 | 0.50 | 674 | 0.67 |

| TR-25-04 | 0.50 | 2740 | >20 |

| TR-25-05 | 0.75 | 210 | 9.68 |

| TR-25-06 | 1.00 | 563 | 0.92 |

| TR-16-01 | 6.40 | 570 | 2.76 |

Note: indicates results from previous analysis in 2016.

Geological Insights

Geologically, Triple Crown is thought to host silver and gold-rich epithermal veins that lie outboard of a potential porphyry-style copper-gold system. Interestingly, the area has seen minimal historical exploration, which adds layers of intrigue and potential for future findings. The 2025 exploration campaign also brought to light the Central Zone, a newly identified porphyry target, spanning approximately 1,000 m by 900 m. Here, soil anomalies show signs of copper (up to 4780 ppm) and bismuth (up to 427 ppm), combined with geological formations that include Mid-Cretaceous Whitehorse Suite granodiorite and various volcanic rock types.

Assaying Methodology

Accurate and reliable data is paramount in resource exploration, and for this purpose, Strategic Metals partnered with ALS Minerals. Sample preparation took place in Whitehorse, Yukon, with rigorous analyses shipped to their North Vancouver labs. Rock samples underwent comprehensive testing for gold using fire assay fusion and were subjected to various geochemical analyses, ensuring that results are thoroughly validated. Overlimit values for silver, lead, and zinc were identified using advanced techniques to guarantee accurate readings in high concentrations.

Leadership and Governance

The technical details of this exploration release have received a green light from Jackson Morton, the Vice President of Exploration for Strategic Metals. His expertise, underscored by qualifications defined under National Instrument 43-101, bolsters investor confidence in the reported findings.

About Strategic Metals Ltd.

Strategic Metals Ltd. is not merely a mining company but a dedicated project generator. With 15 royalty interests and a portfolio encompassing 83 wholly-owned projects, the company is rooted in a tenure of over 50 years focused on exploration. They also actively engage in options and joint ventures, leveraging high-grade surface showings and geophysical features to enhance their prospects.

Positioned strategically in the mineral exploration business, Strategic boasts a cash position hovering around $1.2 million, alongside significant equity stakes in several active exploration companies like Broden Mining Ltd. and GGL Resources Corp. This diverse investment strategy illustrates Strategic’s commitment to both resource development and pioneering sustainable practices, such as their investment in Terra CO2 Technologies Holdings Inc., aimed at revolutionizing cement production.

Exploring the Future

As exploration continues at the Triple Crown Project, the mining community remains eagerly abreast of Strategic Metals’ advancements, keen to see how the ongoing investigations affect the company’s trajectory in this promising sector. Interested individuals can gain further insights into Strategic’s endeavors and access investor communications through their website.

This unfolding narrative accentuates the potential for remarkable discoveries in the Yukon, as well as Strategic Metals Ltd.’s role in shaping the future of mineral exploration and sustainable resource management.